February 6th, 2020

Audiences today face an abundance of choice in their viewing experience, and they’re watching more premium video every day. Much of this behavior is driven by on-demand library content, as we’ve seen significant audience growth in streaming platforms. In 2019, three in four households were accessing a streaming platform and 190 billion hours of on-demand video was streamed. Audiences are now empowered to program what, when, and how they watch content.

WE BRING TOGETHER STORIES THAT SHAPE CULTURE

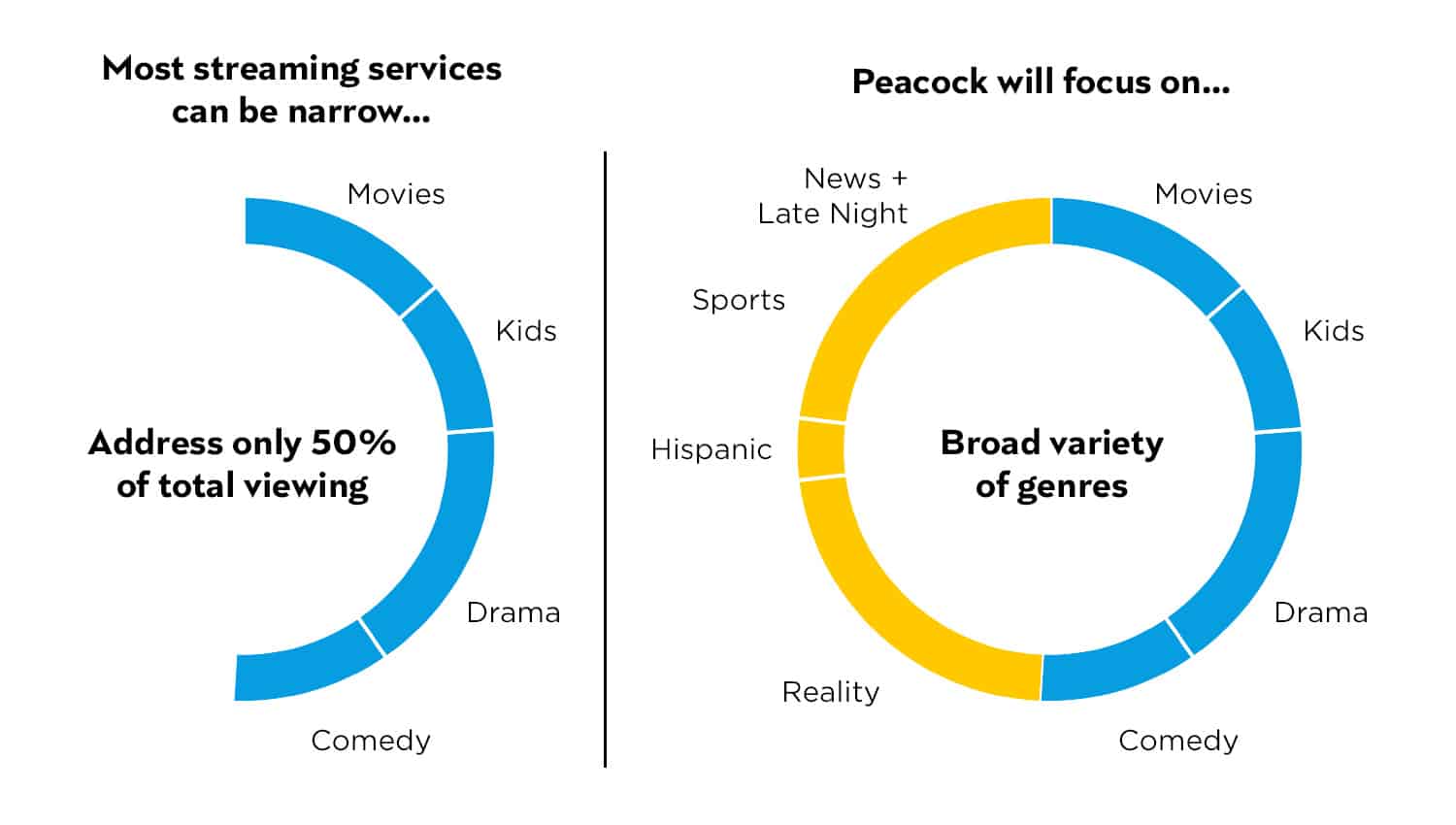

The launch of Peacock will meet these audiences where they are with something for everyone. Streaming services can be narrow in their genre focus, but Peacock’s extensive library at launch will address a more holistic picture of household viewing behavior.

By connecting with broader audiences, Peacock builds on NBCUniversal’s legacy of shaping shared culture. For anything from quotable comedies to gripping dramas and enduring blockbusters, audiences have come to our platform to watch and rewatch the stories that define who we are. Peacock will bring together the best culture-defining content of the past, present, and future.

Click here to learn more about the broad variety of content that will be available on Peacock.

OUR STORIES ENGAGE AUDIENCES AT SCALE

Our broad catalog allows audiences to personalize what they watch, while streaming enables them to watch at their desired time and platform. This behavior has multiplied our audiences. They want to catch up with timely content to participate in larger cultural conversations that keep them more connected with others. Many also turn to repeating familiar experiences, with 4 in 5 people saying they regularly rewatch TV shows or movies. Audiences will rewatch for the comfort, convenience, and nostalgia for a timeless story. Peacock meets this behavior with the stories that audiences return to most on streaming.

-

Most-Watched

-

on Netflix

-

Most-Watched

-

on Hulu

-

Most-Watched

-

on YouTube

AUDIENCES LEAN IN WITH FREE, AVOD STREAMING

Personalized streaming creates an even better advertising experience when it’s offered free to consumers. The vast majority of viewers would choose a free service with ads over a paid service without them. Peacock’s nationwide launch will give the flexibility of choice to everyone, allowing all audiences to stream Peacock content across platforms on both Free and Premium tiers.

PEACOCK’S NEW ADVERTISING PLAYBOOK

Peacock marks the next phase of our One Platform offering – reaching all audiences in one place with a premium content experience at massive scale. Audiences value advertising in this context because it gives them the premium content they want. When this advertising is delivered with the industry’s lightest ad load, a new standard in frequency caps, and it’s relevant to the viewer’s favorite content, brands can benefit from audiences’ engagement.

Peacock marks the next phase of our One Platform offering – reaching all audiences in one place with a premium content experience at massive scale. Audiences value advertising in this context because it gives them the premium content they want. When this advertising is delivered with the industry’s lightest ad load, a new standard in frequency caps, and it’s relevant to the viewer’s favorite content, brands can benefit from audiences’ engagement.

Advertisers’ investment in Peacock is backed by the strength of our entire platform. With integrated media across every channel, a full suite of talent and creative capabilities, and innovative solutions to make the ad experience better for audiences, we’re committed to partnering with advertisers in shaping the future.

Click here to learn more about the ad experience with Peacock.

Stay tuned to learn more about News from NBCU

Sources

“…watching more premium video…”

Live Linear & DVR – Nielsen, NPower, Total Day. 2009 based on Live and L7 TV usage. 2019E based on 2019 Live TV and DVR usage thru Oct vs same months in 2018 applied to full year 2018. VOD – comScore

OnDemand Essentials. 2009 press release. 2019E based on 2019 usage thru Oct vs same months in 2018 applied to full year 2018.

SVOD/AVOD: 2019 based on NBCU estimates based on public company statements, comScore, Nielsen data. All data modeled down for U.S.; 2009 based on comScore VideoMetrix total market monthly data

“3/4 households were accessing a streaming platform and 190b hours of on-demand video was streamed”

Nielsen Media Research, HH w SVOD Subscription, 2Q19 vs. 2Q18 2Nielsen National Cable Coverage UEs, Total Multi-Channel, average monthly of 2Q19 vs. 2Q18

Live Linear & DVR – Nielsen, NPower, Total Day. 2009 based on Live and L7 TV usage. 2019E based on 2019 Live TV and DVR usage thru Oct vs same months in 2018 applied to full year 2018. VOD – comScore

OnDemand Essentials. 2009 press release. 2019E based on 2019 usage thru Oct vs same months in 2018 applied to full year 2018.

SVOD/AVOD: 2019 based on NBCU estimates based on public company statements, comScore, Nielsen data. All data modeled down for U.S.; 2009 based on comScore VideoMetrix total market monthly data.

Hulu Ad vs Ad Free based on NBCU content ratio.

Streaming Hours includes YouTube, Netflix, Hulu, Amazon Prime

“4 in 5 people saying they regularly rewatch TV shows or movies”

Source: Gartner Consumer Behaviors and Attitudes Survey, 2019

“…the stories that audiences return to most on streaming.”

The Office: Source: Nielsen, Npower, 11/1/2018-10/31/2019, P2+, Total Hours

Brooklyn 99: 7Park Data Jan 2019-Oct 2019; average month % of total Hulu users

YouTube: Tubular as of 12/5/2019; Entertainment, US Only, Oct views by channel

“majority of viewers choose a free service with ads over a paid service without them…”

Source: November 2019, Federated Sample via Research Results. N=1997. Q: Which of the following options would make you most likely to try out a new streaming service? 79% selected Free w/ minimal advertising (limited interruptions)